Child Poverty Grows, Making Anti-Hunger Services Critical

At a time when key supports, including the country’s most effective hunger prevention programs, are at risk for children and families in Arizona, new data tells us just how critical essential services are for children in need.

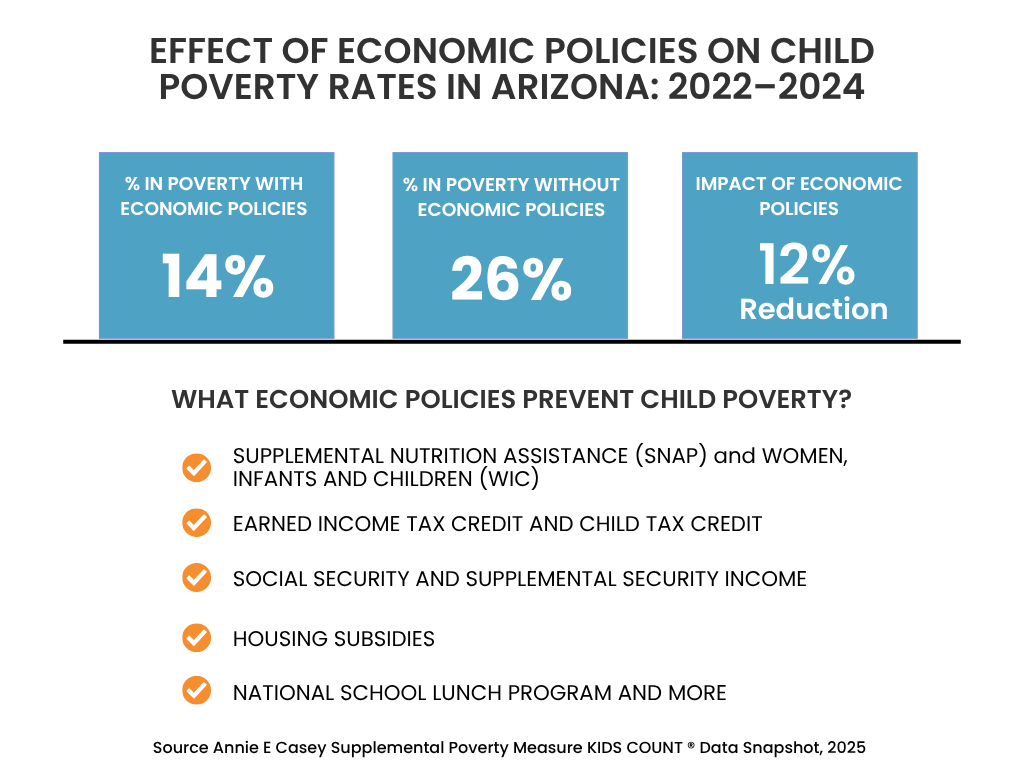

According to the supplemental poverty measure, child poverty in Arizona increased from 10% (2019 – 2021) to 14% (2022 – 2024). That increase is tough enough for Arizona children, but it would have been dramatically worse if not for critical programs like the Supplemental Nutrition Assistance Program (SNAP) and Women, Infants, and Children (WIC).

A new report from the Annie E Casey Foundation, MEASURING ACCESS TO OPPORTUNITY IN THE UNITED STATES: A 10-Year Update, Supplemental Poverty Measure KIDS COUNT ® Data Snapshot, shares data for policymakers, parents, and organizations and businesses to understand the challenge families are facing to ensure their children have enough to eat, to keep a roof over their head, and to meet their basic needs.

Every year, the Census Bureau issues two methods of analysis of poverty. One is the standard poverty rate, and one is the supplemental poverty measure. The supplemental poverty rate is the only method that considers geographic differences in housing costs and that shows the effects of economic policies put in place by policy makers.

REPORT FINDING: ESSENTIAL SERVICES MAKE A DIFFERENCE FOR CHILDREN

↓ In 2021, with federal pandemic relief and an expanded child tax credit in place, the nation’s child poverty rate was 5% — the lowest rate on record.

↗ By 2024, child poverty nearly tripled to 13%, returning to pre-pandemic levels. This troubling increase occurred even though 61% of children in poverty lived in families with at least one working parent, underscoring that wages and supports are not keeping pace with costs

🚨 Without public services, the child poverty rate would have increased to 25% in 2024. Vital services that keep many of our nation’s children out of poverty include: tax credits, Social Security, Supplemental Security Income (SSI), food assistance such as SNAP, and housing subsidies.

REPORT FINDING: MORE CHILDREN WILL LIVE IN POVERTY IF ECONOMIC POLICIES AREN’T IN PLACE TO SUPPORT THEIR BASIC NEEDS

Between 2022–2024, federal and state policies together lowered child poverty rates by 12 percentage points in Arizona. That’s a difference of 191,000 children who would otherwise live in poverty if vital economic supports were not available.

This Data is Especially Alarming as SNAP and WIC Are at Risk

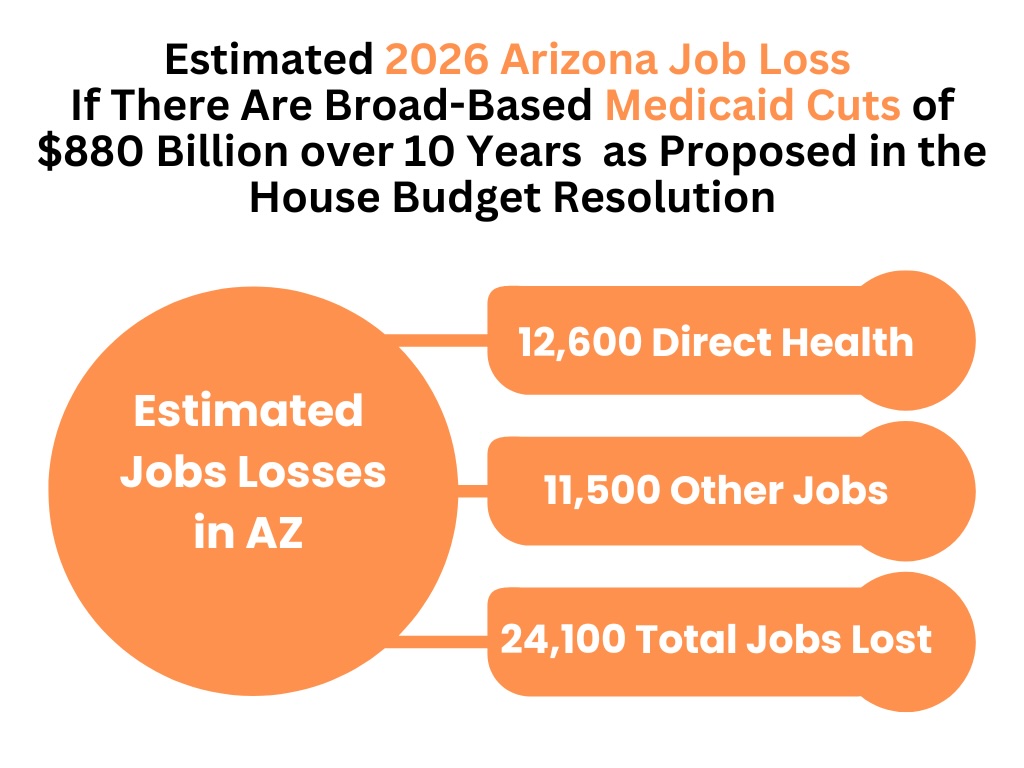

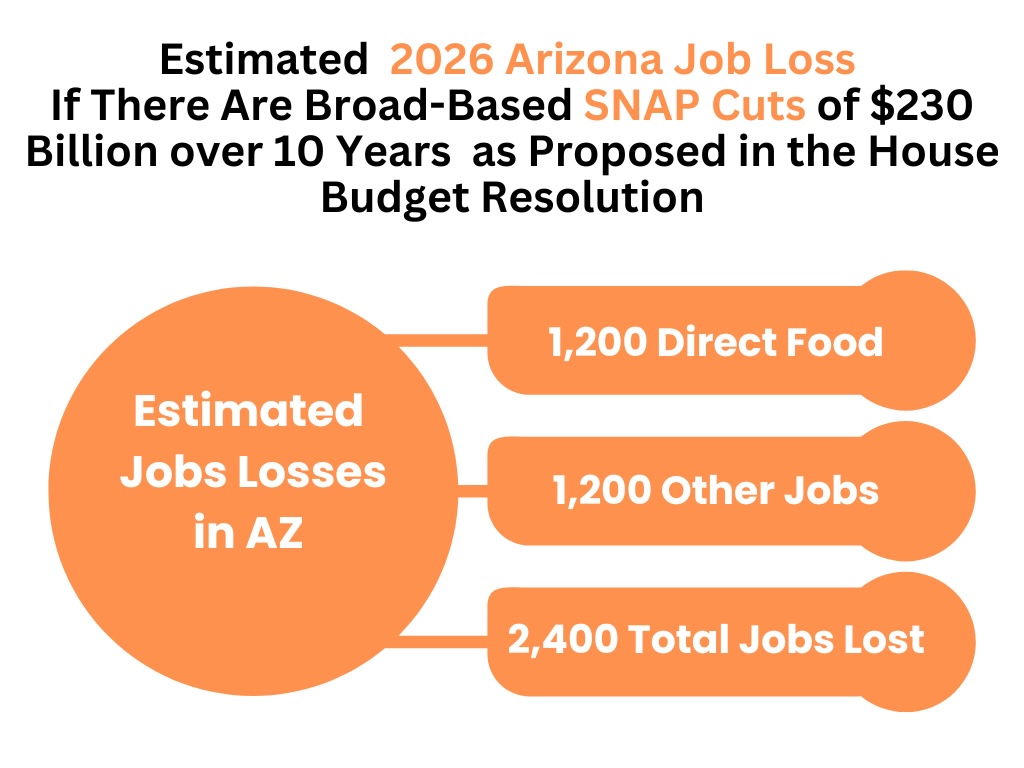

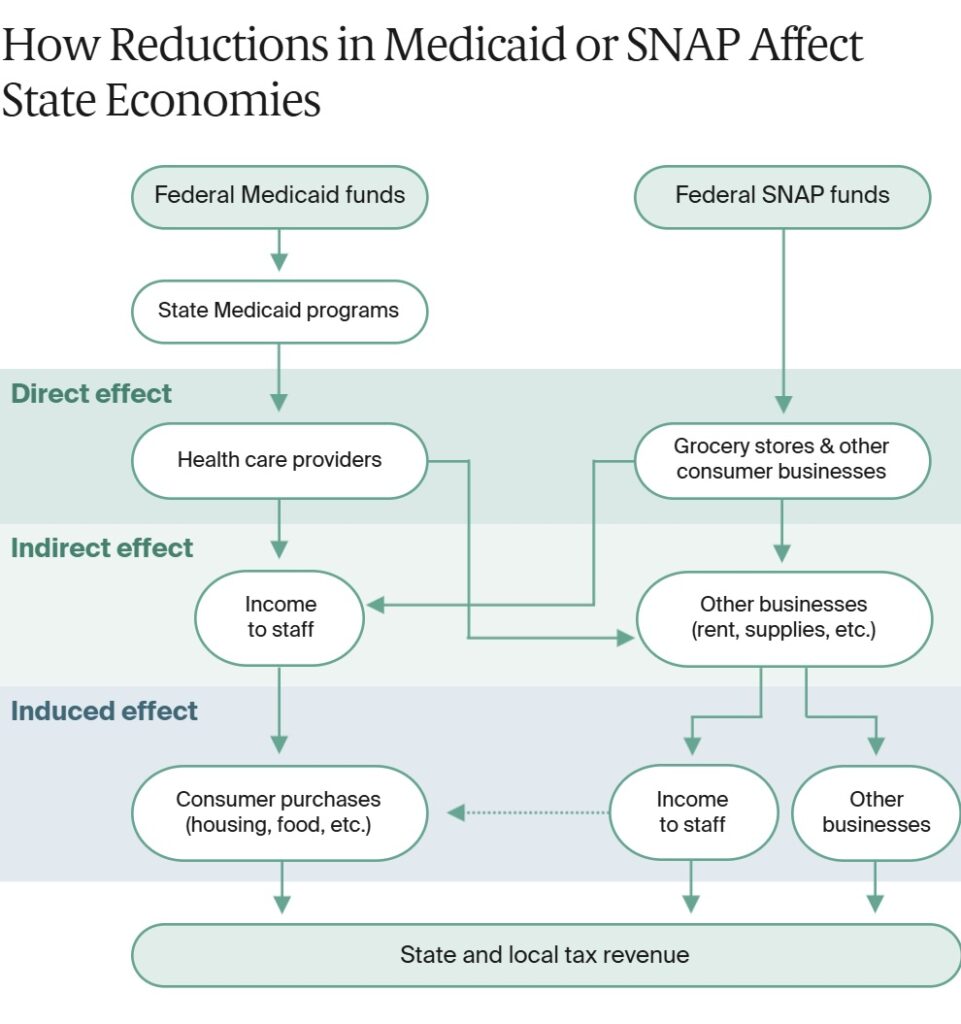

It is important to understand how decisions that are being made in our nation’s capital affect us here in Arizona, including children. Already this year, Congress made steep cuts to Medicaid/AHCCCS health care services and SNAP through the budget reconciliation bill titled One Big Beautiful Bill. Now, even though a contingency reserve fund is available to fund SNAP benefits during an appropriations lapse, the executive branch is refusing to deploy these reserve funds.

As we turn a corner into November, SNAP and WIC assistance may be delayed or unavailable for parents and children who can’t afford groceries, unless the U.S. Department of Agriculture immediately deploys the contingency funds it has available or the executive branch uses its transfer authority to allocate funds to fight hunger or Congress takes action.

Failing to fund SNAP, WIC and other vital supports will add to the difficult struggles of children and families, and will force more children into poverty and hunger. Solutions and action are needed now.

On this #SNAPDayOfAction, we are facing a crucial moment to protect programs like SNAP and WIC, which make a significant difference for thousands of families and children in Arizona to access basic needs.