Budget Proposal Shortchanges Arizona Children and Families

The Arizona legislature is considering a new state budget proposal this week as they seek to avoid a state government shutdown with only 8 days remaining before the deadline. While we wish we could praise this budget proposal for including some new investments that we have been seeking for many years, unfortunately, those new investments do not outweigh the fact that overall this is a budget that shortchanges the future for Arizona children and families.

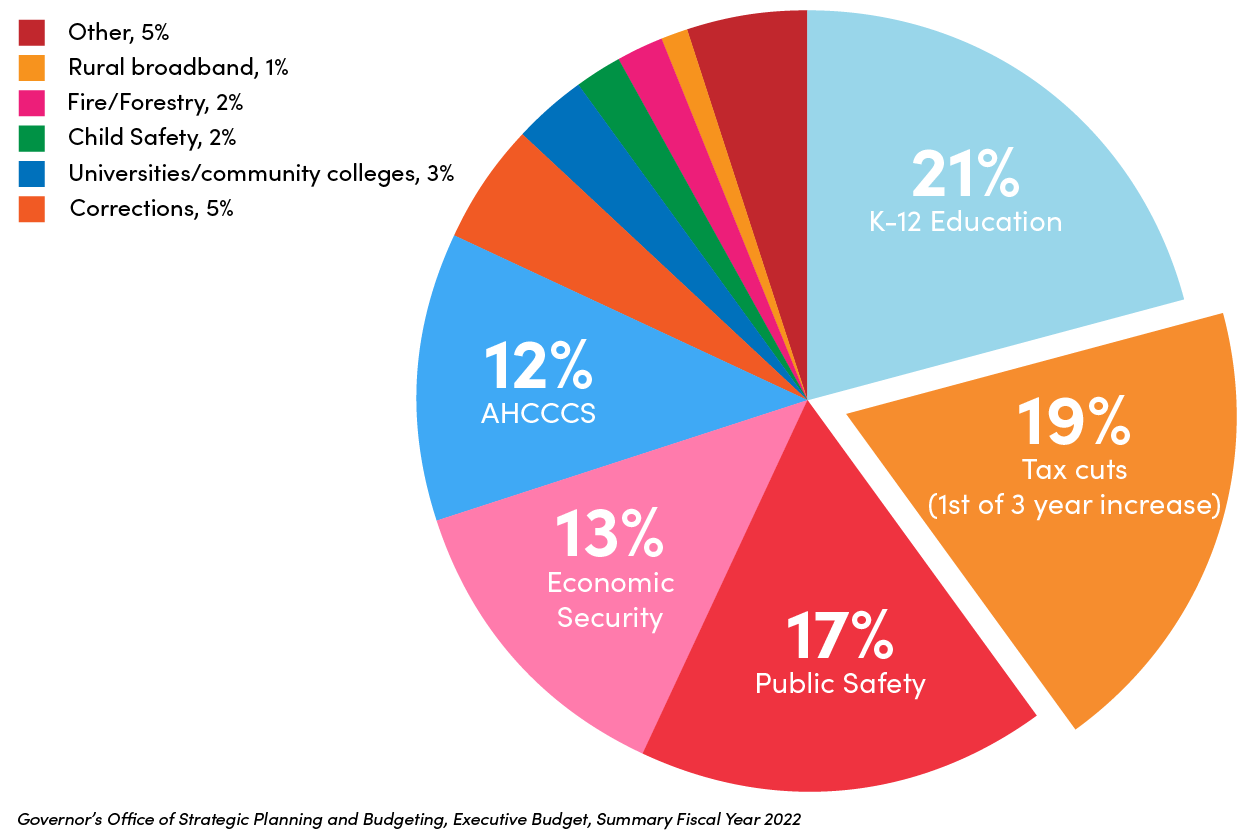

State lawmakers have an unprecedented $5 billion revenue surplus on-hand as they work to craft the state budget. The revenue surplus provides an opportunity to make much-needed new investments for things that have been underfunded for years, like K-12 public education, children’s access to health care, and early childhood education. It also requires lawmakers to make fiscally responsible decisions that will avoid huge budget cuts the next time there is an economic downturn.

Unfortunately, the budget proposal being considered this week both misses many opportunities to make the meaningful new investments that are necessary, and it includes fiscally irresponsible tax cuts and funding shifts that, when the next recession hits, will jeopardize future funding for the resources that children and families count on.

Read our summary of the budget proposal covering what’s good, what’s bad, and what’s missing or not enough.

The Good

Kinship care stipend increase – Increases the stipend paid to grandparents and other relatives who are caring for children family members placed with them through the foster care system from $75 a month to $300 a month. 52% of the children currently in Arizona’s foster care system are placed with relatives, yet non-relative foster homes receive considerably more ($641 a month) than the relative foster providers.

Healthy Families – Invests $15 million to fill the funding gap for Healthy Families, a nationally accredited, evidence based voluntary home visitation program for new parents that sets the foundation for a healthy start to their child’s life.

Postpartum AHCCCS coverage – Expands AHCCCS coverage (Arizona’s Medicaid program) for one year after pregnancy ends to pregnant people earning less than 156% of the federal poverty level who also meet residency and citizenship requirements. Currently, eligibility is reevaluated 60 days after their pregnancy ends.

AHCCCS eligibility for foster youth – Appropriates funding to eliminate unnecessary bureaucratic procedures, and align Arizona law with federal law allowing former foster youth to stay enrolled in Medicaid until age 26.

The Bad

Property tax cuts – Eliminates a $344 million annual funding source for public education by repealing a state property tax. By eliminating this state property tax, it will place a greater responsibility to fund public schools on the state. This loss of revenue will be felt during future economic downturns, making public education more susceptible to future budget cuts.

Expands private school tax credits – reduces state revenues by $2 million this year, with that amount growing annually, to expand the amount of public tax dollars being redirected to private school tuition organizations leaving fewer dollars available to invest in public schools.

Expansion of private school vouchers – While not in the budget itself, it is widely believed that a budget deal is contingent on a major expansion of private school vouchers. Even though Arizona voters overwhelmingly rejected private school vouchers at the ballot box, lawmakers continue to want to divert public tax dollars away from underfunded public schools to private schools.

Missing or Not Enough

Not enough for K-12 public education – The budget proposes $540 million in new ongoing investments for K-12 public education. With Arizona ranked 49th in per pupil funding, and with a growing teacher shortage crisis, it would be inexcusable to not use more of the unprecedented $5 billion surplus to make significant new investments in our public schools. Arizona voters passed Prop 208 in 2020, only to have the Supreme Court strike the measure down earlier this year. Prop 208 would have provided nearly $1 billion in ongoing funding for public education annually. The legislature can and should provide at least the amount of new ongoing funding that Prop 208 would have provided.

Missing is any fix to the constitutional school spending limit – Any new investments in public education will be meaningless if schools cannot spend those dollars. That will almost certainly be the case next year and every year thereafter unless the legislature refers a measure to the November ballot to either repeal or modernize the outdated school spending limit in the state constitution. Currently, the school spending limit is outdated based on what it cost to educate students in 1980.

Missing are any new investments to expand eligibility for children’s heath care - KidsCare is Arizona's Children's Health Insurance Program. It provides low-cost care to children under 19 who live in households earning between 133-200% of the federal poverty limit. Arizona has the fourth-highest rate of uninsured children in the U.S., and more than 16,000 - 10% of all uninsured children in our state - live in households earning slightly too much to qualify for KidsCare. A $12 million appropriation would expand eligibility to thousands of Arizona children.

Missing are any new investments to make child care more affordable – Child care is crucial to Arizona’s economy. For the past decade, Arizona has eliminated almost all state funding for resources to make child care more affordable for Arizona families.